- Home

- /

- Industries

- /

- Insurance Software Development

Take the leap into the future of insurance with Nickelfox

Don’t let outdated software hold you back! Take the leap into the future of insurance with Nickelfox with streamlined operations, enhanced productivity, and better customer experience.

Policy Management Systems

Claims Management Solutions

Quoting and Underwriting Software

Customer Relationship Management (CRM) Tools

Agency Management Systems

Document Management Solutions

Insurance Portal Development

Security and Compliance Software

A trusted digital technology partner for Insurance Businesses

Empower your insurance business with Nickelfox as your trusted digital technology partner. Our expertise in insurance software development encompasses everything from claims and policy management to underwriting and CRM applications.

Policy Management Systems

We design and develop custom policy management systems that streamline the entire policy lifecycle, from application and underwriting to claims processing and renewals. Our solutions automate processes, improve accuracy, and enhance overall efficiency.

Data Analytics and Business Intelligence

Gain valuable insights from your insurance data with our data analytics and business intelligence solutions. We help you harness the power of data to make data-driven decisions, identify trends, mitigate risks, and drive business growth.

Claims Management Solutions

Our custom claims management solutions optimize the claims handling process, reducing paperwork, improving communication, and accelerating claim resolution. With advanced features like automated workflows and real-time analytics, we help you deliver prompt and exceptional claims services.

Document Management Solutions

Our custom document management solutions digitize and automate document-intensive processes, such as policy documentation, claims forms, and compliance paperwork. Say goodbye to manual paperwork, improve document retrieval, and ensure regulatory compliance.

Quoting and Underwriting Software

Simplify the quoting and underwriting process with our tailored software solutions. We create intuitive systems that enable quick and accurate risk assessment, policy pricing, and quoting, empowering your team to make informed decisions and provide competitive quotes.

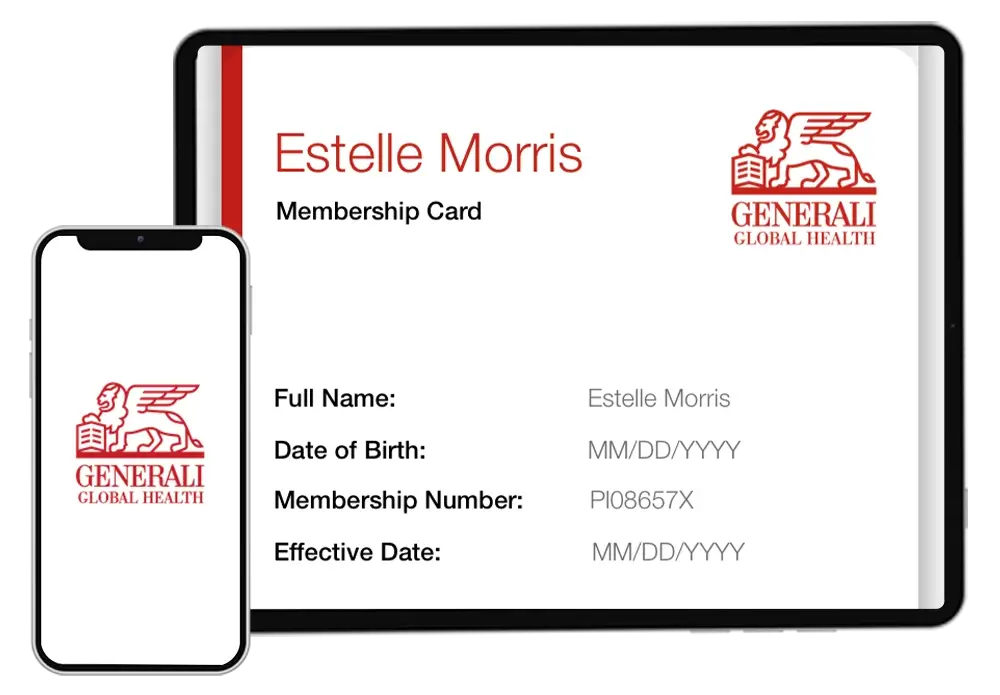

Insurance Portal Development

We create secure and user-friendly insurance portals that enable policyholders, agents, and brokers to access policy information, submit claims, make payments, and manage policies online. Our portals enhance self-service capabilities and improve customer engagement.

Customer Relationship Management (CRM) Tools

Enhance customer satisfaction and retention with our CRM tools designed specifically for the insurance industry. Our solutions enable efficient customer data management, personalized communication, and streamlined customer interactions for improved service delivery.

Integration with Third-Party Systems

Seamlessly integrate your insurance software with third-party systems, such as payment gateways, regulatory databases, and external data sources. Our expertise in API integration ensures smooth data exchange, process automation, and system interoperability.

Agency Management Systems

We develop agency management systems that centralize operations, automate workflows, and facilitate seamless collaboration between agents, brokers, and insurers. Our solutions empower agencies to efficiently manage policies, commissions, customer relationships, and more.

Security and Compliance Software

Protect your sensitive data and ensure compliance with industry regulations. We implement robust security measures, including encryption, access controls, and audit trails, to safeguard your information and maintain regulatory compliance.

Don't miss out on the benefits of insurance technology solutions

Latest technology stack for Insurance Software Development

At Nickelfox, we leverage cutting-edge technology stack for developing insurance software that is robust, secure, scalable, and aligned with industry standards.

Programming Languages

We build the backend logic and functionality of insurance software solutions utilizing programming languages such as Java, Python, C#, and JavaScript.

Databases

Microsoft SQL, NoSQL and other relational databases like MongoDB, Cassandra MySQL, and PostgreSQL make up our technology stack for insurance software products.

Cloud Platforms

We leverage cloud platforms such as Amazon Web Services (AWS) and Microsoft Azure to develop scalable and flexible insurance software solutions.

Frontend Technologies

Modern frontend technologies like HTML5, CSS3 and JavaScript frameworks such as React.js, Angular, and Vue.js to power up intuitive interfaces for insurance applications.

API Development

We build robust APIs using RESTful architecture, GraphQL, and SOAP to facilitate data exchange and seamless integration of insurance software with external systems.

Data Analytics and Business Intelligence

We enable insurance companies to gain valuable insights from data employing technologies such as Apache Hadoop, Apache Spark, and Tableau.

Security and Encryption

Strict security measures to maintain compliances by ensuring secure data and software architecture through SSL/TLS encryption, OAuth, and JSON Web Tokens (JWT).

Mobile Development

We utilize React Native and Flutter for cross-platform app development. The technology stack also includes Swift and Xcode for iOS apps and Java and Kotlin for Android apps.

Maximize productivity and minimize costs with optimized Insurance Software

Why Nickelfox for Insurance Software Development

Choosing Nickelfox for insurance software development brings numerous advantages that set us apart from the competition. Here’s why we are the ideal partner for your insurance software development needs:

Domain Expertise

With a clear understanding of unique challenges, regulatory requirements, and business processes of the insurance industry, we at Nickelfox have gained deep domain knowledge to deliver insurance-specific software solutions.

Customization

The software we develop aligns perfectly with your business requirements and workflows as our approach is centered around clients’ requirements. We collaborate closely to understand your goals and deliver a solution that exceeds your expectations.

Technological Excellence

Our team consists of highly skilled and experienced developers proficient in the latest technologies and frameworks. The insurance software we develop leverages the most advanced tools and techniques to deliver optimal performance, scalability, and security.

Agile Methodology

We follow agile development practices, allowing for iterative and flexible project management. Through communication, transparency, and continuous feedback, we ensure that your project remains on track and is delivered within the agreed timelines.

User-Centric Approach

Our approach to the insurance software development process is user-centric. of UX/UI designers craft intuitive and visually appealing interfaces for insurance software that are easy to navigate, promise a seamless user experience, and drive conversions.

Quality Assurance

Delivering quality in the software we develop for the insurance industry. Our dedicated quality assurance team conducts rigorous testing and debugging processes to ensure that your software functions flawlessly and performs optimally.

Client-Centric Approach

We go above and beyond to understand the objectives of your insurance business. Our priorities lie in building long-term relationships with our clients aiming to deliver solutions that drive growth, efficiency, and profitability for your insurance business.

End-to-End Solutions

Experience a hassle-free journey with our all-inclusive services through entire project lifecycle. We start from the ground up, ideating and designing the initial prototype, followed by development, testing, deployment, and continuous support.

Embrace digital transformation in the insurance industry with Nickelfox

Frequently Asked Questions

Take a look at some of the most common questions about our insurance development services to develop familiarity with our digital technology offering for the insurance industry.

What is insurance software development?

Insurance software development refers to the process of designing, building, and implementing software solutions specifically tailored for the insurance industry.

What insurance software development services does Nickelfox offer?

Our expertise includes developing custom insurance software solutions, policy management systems, claims processing platforms, underwriting tools, insurance CRM systems, and more.

Is insurance software development customizable to my specific business requirements?

Yes. We work closely with you to understand your specific requirements, workflows, and business goals. The developers and designers at Nickelfox can then create tailor-made solutions that align with your specific business needs.

How long does it take to develop insurance software?

At Nickelfox, we follow an agile development approach to ensure timely delivery. However, the actual development timeline for insurance software can vary depending on the complexity of the project, features and functionalities required, and several other factors.

Can you integrate insurance software with existing systems?

Yes, we ensure seamless integration to enable data synchronization. We have experience in integrating insurance software with existing systems such as legacy applications, third-party APIs, databases, and more.

Do you offer post-development support and maintenance?

Yes. We provide comprehensive post-development support and maintenance to ensure the smooth functioning of your insurance software solution. Our team is readily available to provide ongoing technical assistance to keep your software up to date and optimized.

Is my data secure with Nickelfox during insurance software development?

Absolutely. At Nickelfox, we prioritize the security and confidentiality of our clients' data. We follow industry best practices and implement robust security measures to protect your data throughout the insurance software development process.